Lendingkart Business Loan

Our Services

Benefits of Lendingkart Business Loan

Loan Amount

₹1 to ₹35 lakhs

Tenure

1 to 36 months

Application Process

●Completely online process

●Minimum documentation

Interest Rates

18% - 26.4% p.a

Important Terms & Conditions

You should enter your PIN code as per Aadhaar/Passport/KYC document

You must be a new user to apply for the loan

Approval/rejection of loan application is solely at the discretion of Lendingkart.

Eligibility Criteria Self Employed

- Age Group: 23 to 60 years

- Income Range: ≥ ₹12 lakhs p. a.

- Documents Required:

-

Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving License, or any other government-approved ID

-

Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID

-

Income Proof: One-year Bank Statement (all business-related bank accounts in original net-banking PDF), If loan amount is >₹10 lakhs, then GST Return for last 4 quarters and ITR of last 2 years might be required

Eligibility Criteria Self-employed

Documents Required:

- Business Proof: GST Certificate as applicable

-

1. Business Registration Proof (Shop & Establishment Act, Municipal Corporation/Mahanagar Palika/Gram Panchayat Udyam Registration, Drugs License/Food and Drugs Control Certificate),

-

2. Certificate of Incorporation,

-

3. Certificate of Registration with Appropriate Registration Body,

-

4. PAN Card of the firm and all directors/partners & KYC documents,

-

5. Aadhar Card of all directors/partners

Other Eligibility Criteria

- Customer must be an Indian resident

- CIBIL score must be 650+

Application Process

Start with Your Basic Details

Please keep the following documents and

details handy to start the process

● Your PAN card

● Aadhaar card and

● Bank account details

● Business proof details

Let’s start!

Visit the Lendingkart Business Loan website by clicking on the link and start the application journey

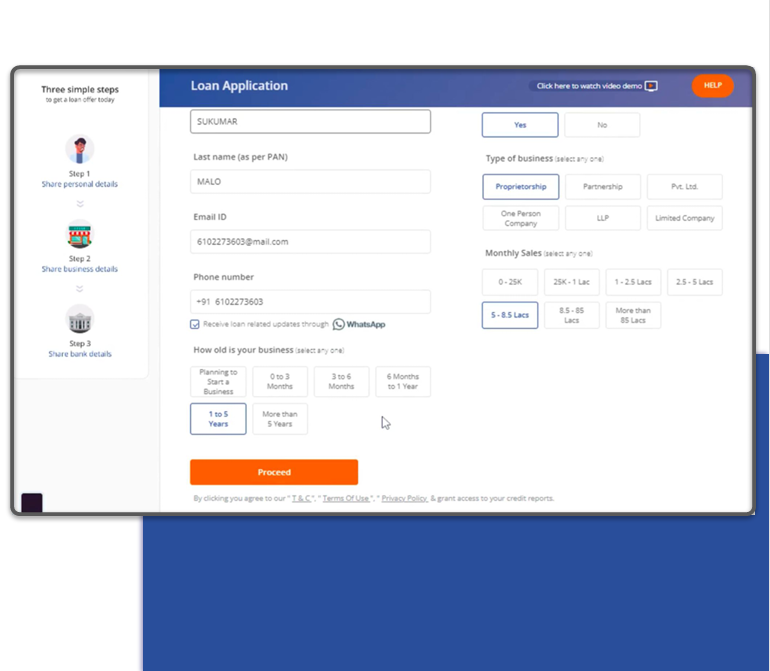

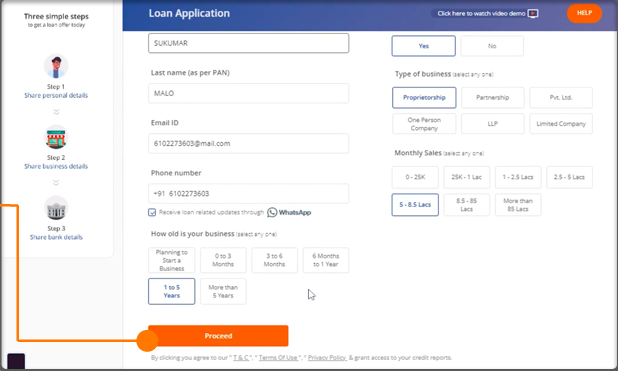

- Step: 1

Filling in your Personal Details

● Enter your name as per your PAN. Also, enter your Email ID and phone number. You can opt to receive loan-related updates on WhatsApp.

● Please enter your business details such as Business Registration Proof, Type of Business, Monthly Sales, and the age of your business. Select the options that apply. After entering your business details, click on Proceed.

● Enter the OTP sent your phone number and continue.

● Enter your PAN details, Date of Birth, and Residential PIN Code and select Gender. Click on Proceed.

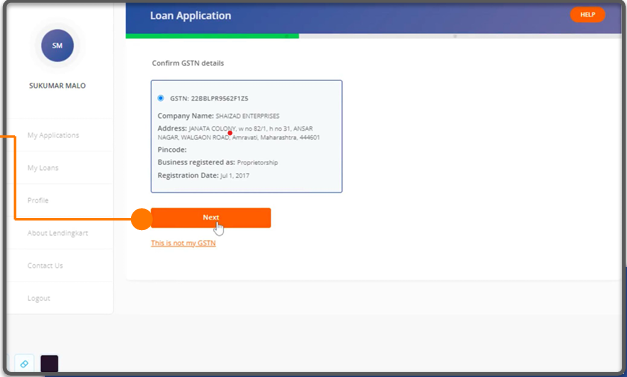

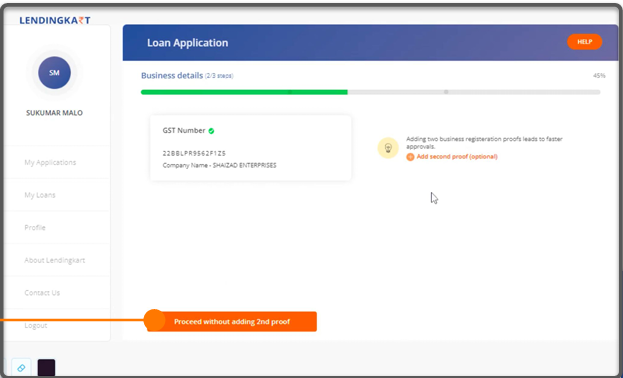

- Step: 2

The second part of the application is filling in your business details:

Confirm your GSTN details and click on Next

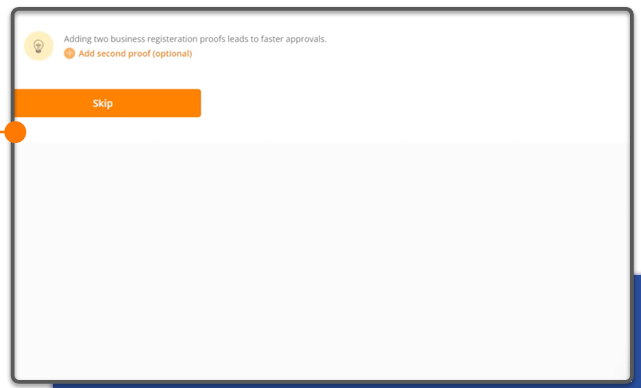

Your GST number will be reflected. Optionally, you can add a second proof of business registration or proceed without adding another proof. Please note that adding two business registration proofs leads to faster approvals.

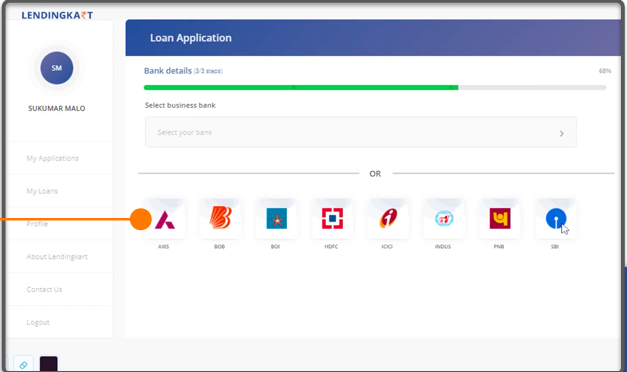

- Step: 3

Fill your bank details:

Select your business bank. You can either select your bank from the drop-down list or choose one of the popular bank icons.

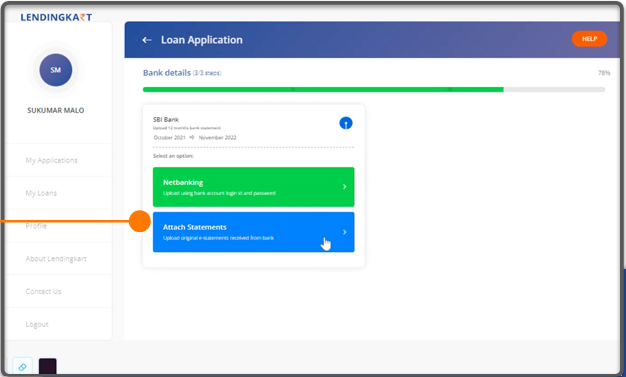

Select either the Net Banking option or Attach original net-banking PDF Statements option.

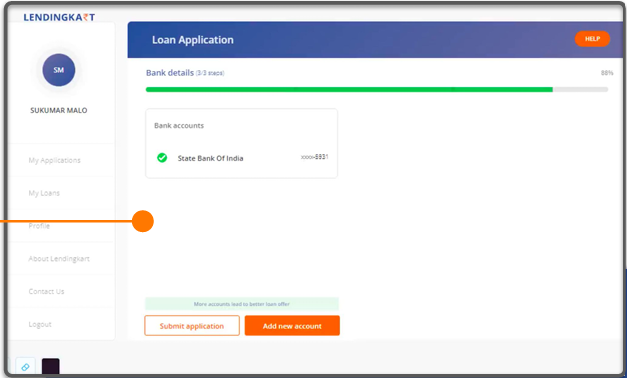

Please note that a lower number of bank accounts may lead to rejection of the application. Make sure you have uploaded all statements of your business banks, and add a new account if necessary. Confirm your bank account(s) and Submit Application.

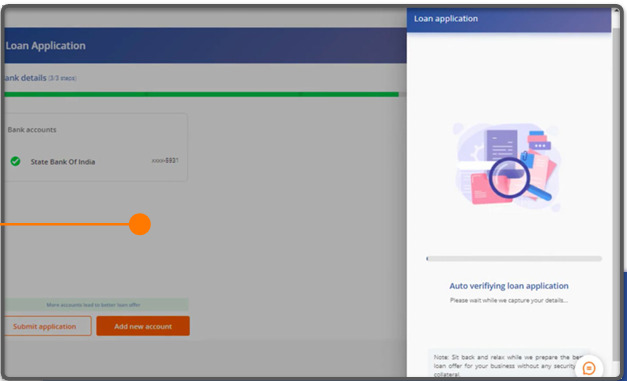

Your application will be auto-verified. In case auto-verification is not possible, your application will be assigned to a loan specialist and assisted verification will be in progress. Your status will then be updated shortly.

- Step: 4

Verifying your information with KYC

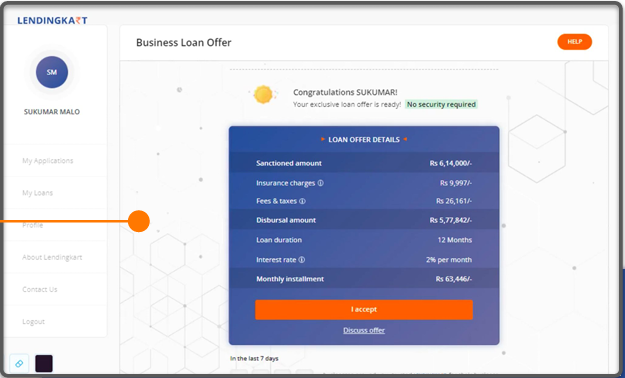

Your loan offer will be reflected along with the sanctioned amount, insurance charges, fees and taxes, disbursal amount, loan duration, interest rate, and monthly instalment details. Click on Accept Offer. If you want to discuss the offer amount you may choose to discuss the offer by clicking on the Discuss offer option.

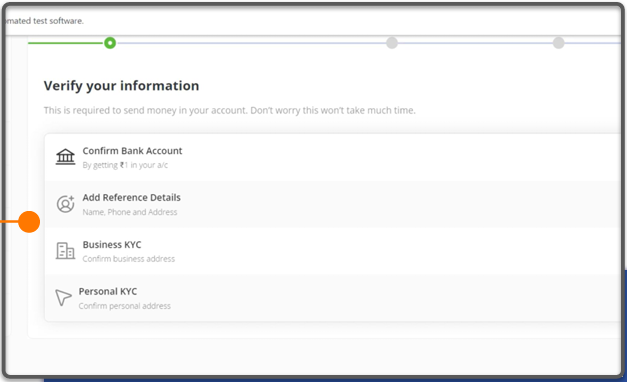

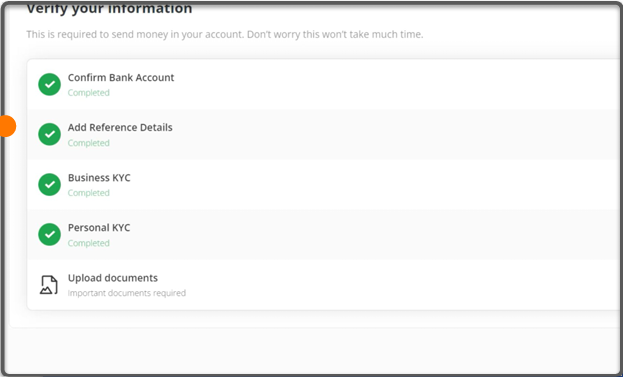

You will be redirected to a “Verify your information” page where you will have to complete four steps:

1. Confirm your Bank Account, Add your Reference Details, your Business KYC, as well as your Personal KYC. Click on “Confirm your Bank Account”.

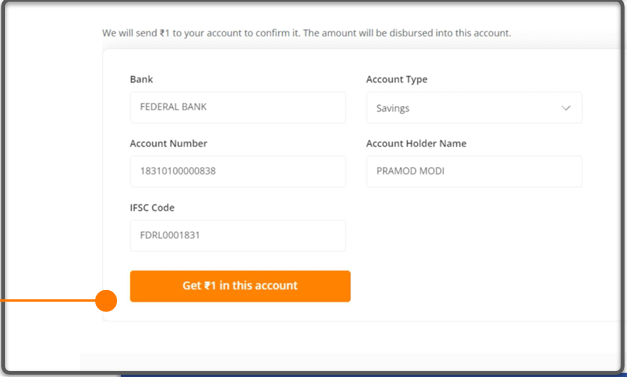

Enter your bank details such as your Account Type, Account Number, Account Holder Name and IFSC code and proceed to click on “Get ₹1 in this Account”.

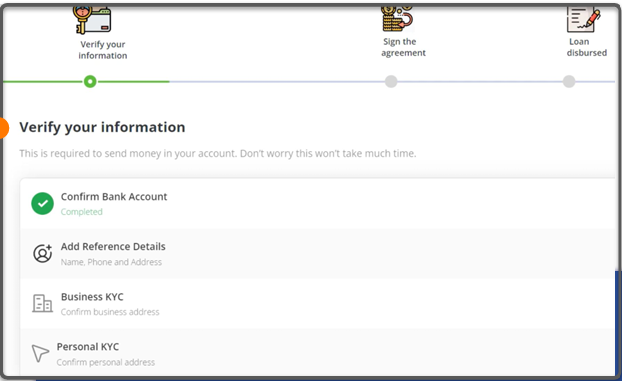

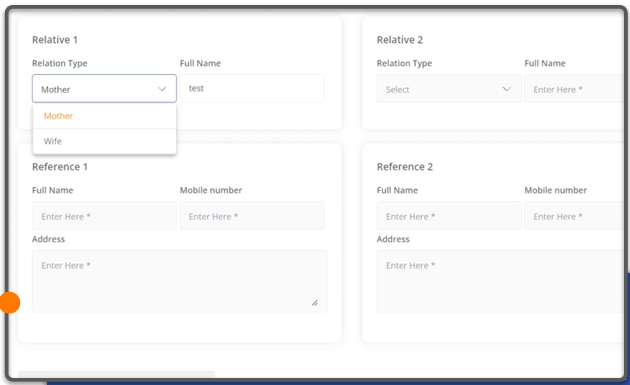

Once your bank account verification is successful, you will be redirected to the main information verification page. Click on Add Reference Details.

Enter your relative and reference details, and click on Save and Proceed.

You will be redirected to the main page again, click on Business KYC. Add your business registration proof. You can optionally add a second business registration proof. Please note that adding two business registration proofs leads to faster approvals. Select your business

and Confirm

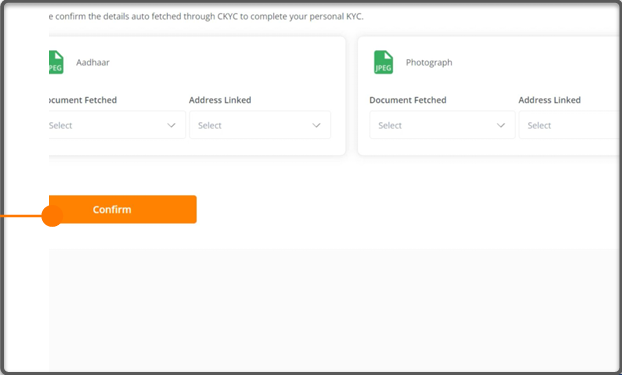

Click on Personal KYC to confirm your personal address. Please confirm the details auto-fetched through CKYC to complete your personal KYC. This includes your Aadhar and Photograph details. Choose the type of document and address from the drop-down list. Once you have selected the options, click on Confirm.

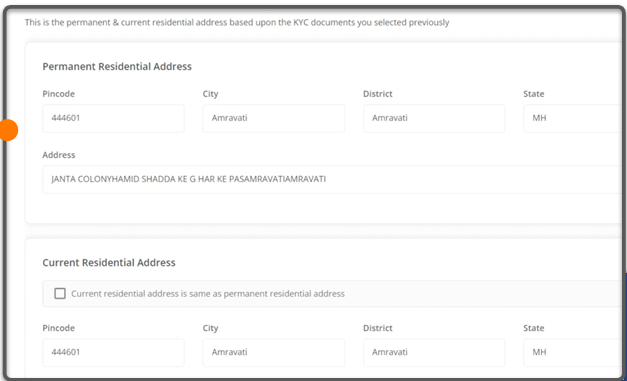

Confirm your permanent and current residential address based on the KYC documents you selected previously and confirm.

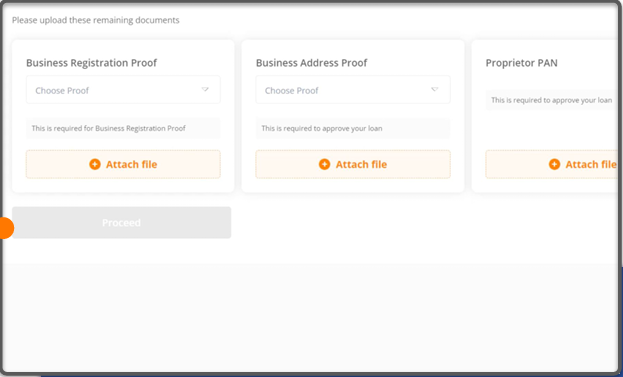

You will be redirected to the main page where you have to complete the last step for information verification. Click on Upload Documents

1. Attach the required documents: Business Registration Proof, Business Address Proof and Proprietor / Director / Partner PAN. Once these documents are attached, click on Proceed.

2. Once you have completed all your steps, your details will be manually verified and the funds will be transferred to your account.

Help & Support FAQs

You can obtain a loan ranging from 1 lakh to 35 lakh.

You can make instalment payments through NACH (National Automated Clearing House) or other prescribed methods to our Group NBFC, where your account will be automatically debited on the due dates.

No, there are no hidden charges. Our Group NBFC charges a processing fee of 2 to 5% of the sanctioned amount.

Required Documents:

Identity Proof: Select one from the following options - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID.

Address Proof: Choose one from the following options - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID

Required Documents:

Identity Proof: Select one from the following options - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID.

Address Proof: Choose one from the following options - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID.

Business Proof: This includes a GST Certificate if applicable, Business Registration Proof (Shop & Establishment Act, Municipal Corporation/Mahanagar Palika/Gram Panchayat, Udyam Registration, Drugs License/Food and Drugs Control Certificate), Certificate of Incorporation, Certificate of Registration with Appropriate Registration Body, PAN Card of the firm and all directors/partners, as well as KYC documents and Aadhar Card of all directors/partners.

Income Proof: A one-year bank statement for all business-related bank accounts in the original net banking PDF format. If the loan amount exceeds ₹10 lakhs, GST Return for the last 4 quarters and ITR of the previous 2 years may also be required.