Home Loan

Our Services

Benefits of Home Loans

Loan Amount

Get home loan up to ₹5 Crores

Tenure

Up to 30 years

Application Process

100% online

Interest Rates

Get home loan up to ₹5 Crores

Important Terms & Conditions

You have to apply for Home Loan using your link

You have to be a new user to apply for the Loan

Eligibility Criteria Salaried

- Age Group: 21 to 55 years

- Income Range: ₹25,000+

- Documents Required:

-

Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

-

Address proof: Any one of the documents - Aadhar Card, Passport, Voter ID Card

-

Income Proof: Salary certificate, Recent salary slip, Employment letter

Eligibility Criteria Self-employed

- Age Group: 21-55 years

- Income Range: You should have a stable source of income

- Documents Required:

-

Identity proof: Any one of the documents - PAN Card, Ration Card, Aadhaar Card, Voter’s ID Card, Driving Licence

-

Address proof: Any one of the documents - Passport, Aadhaar card, Voter’s ID Card

-

Income Proof: ITR (Income Tax Returns) of last 6 months

-

Business Proof: Proof of Business Existence, Certificate of Incorporation, Certificate of Registration with Appropriate Registration Body

Other Eligibility Criteria

- You must be an Indian resident

- CIBIL Score must be 700+

- Minimum home loan must be of ₹25 lakhs

Application Process

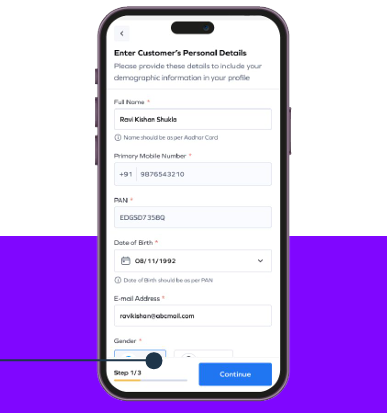

- Step: 1

Start with Your Basic Details

Enter your personal details such as your full name,

primary phone number, PAN Card number, date of

birth, primary email address, and gender.

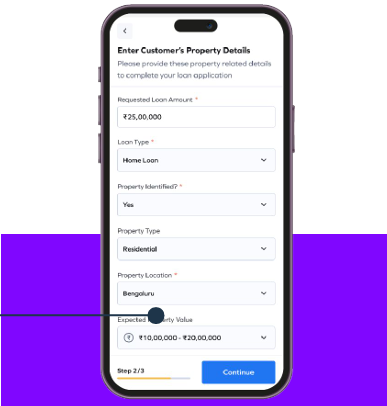

- Step: 2

Provide Property Information

Continue to enter your desired loan amount, select

the type of loan required, and enter the property

identification status and type. Then, enter the

location of the property, the expected value of the

property, and the tenure.

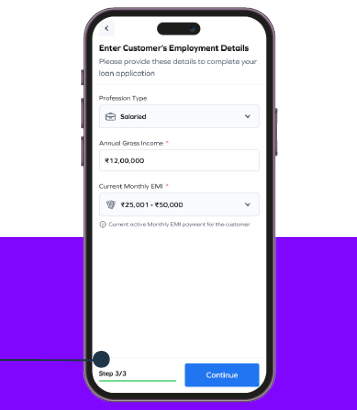

- Step: 3

Provide Your Work Information

Next, enter the employment details, such as

profession type, net annual income, and current

monthly EMI amount.

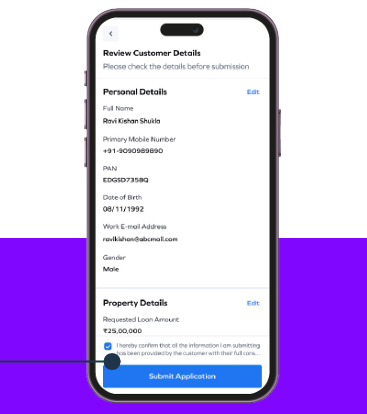

- Step: 4

Final Review Before Submission

Review all the details to make sure everything is

correct. To submit your application, enter the OTP

sent to your mobile number and click “Verify.”

Help & Support FAQs

The required property documents for a home loan can vary depending on the purpose of the loan. Key documents include identity and address proof, income statements, bank statements, credit reports, property documents, and proof of employer address. Requirements may vary across lenders

Lenders assess your ability to repay by considering your total EMI obligations, including the proposed home loan EMI, which should ideally be within 50-60% of your monthly income.

Home loan approval typically takes 1 to 2 weeks but can vary based on the lender’s process, your credit profile, and the property details.

No, home loans do not cover the entire property value. The Reserve Bank of India (RBI) has set Loan-to-Value (LTV) ratio limits. For loans up to Rs 30 lakh, the LTV ratio can be up to 90%. For loans between Rs 30 lakh and Rs 75 lakh, it’s capped at 80%, and for loans above Rs 75 lakh, the LTV ratio is limited to 75%. Borrowers must cover the remaining amount through a down payment.

The maximum home loan amount is determined by the lender using methods like the Multiplier Method or the EMI/NMI Ratio and your profile. These methods consider your income and existing financial obligations. Some lenders also combine these methods to assess your eligibility

The maximum home loan amount is determined by the lender using methods like the Multiplier Method or the EMI/NMI Ratio and your profile. These methods consider your income and existing financial obligations. Some lenders also combine these methods to assess your eligibility

Yes, your spouse or close family members like parents, siblings, or children can co-sign a home loan with you. Additionally, all co-owners of the property must be co-applicants. Applying with a co-applicant can enhance your loan eligibility by combining incomes

Yes, you can prepay your home loan. For floating-rate loans, no prepayment charges apply. However, fixed-rate loans may incur fees, typically 2-4% of the prepaid amount

Yes, having a stable job with a reputable employer and substantial work experience increases your chances of loan approval. Self-employed individuals can still secure home loans with sufficient income proof.

5 Leasted Banks